Condo Insurance in and around Houston

Looking for excellent condo unitowners insurance in Houston?

Insure your condo with State Farm today

Calling All Condo Unitowners!

As with any home, it's a good idea to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has excellent coverage options to fit your needs.

Looking for excellent condo unitowners insurance in Houston?

Insure your condo with State Farm today

Put Those Worries To Rest

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has terrific options to keep your condo and its contents protected. You’ll get coverage options to correspond with your specific needs. Luckily you won’t have to figure that out by yourself. With attention to detail and terrific customer service, Agent Jeff Thomas can walk you through every step to help build a policy that protects your condo unit and everything you’ve invested in.

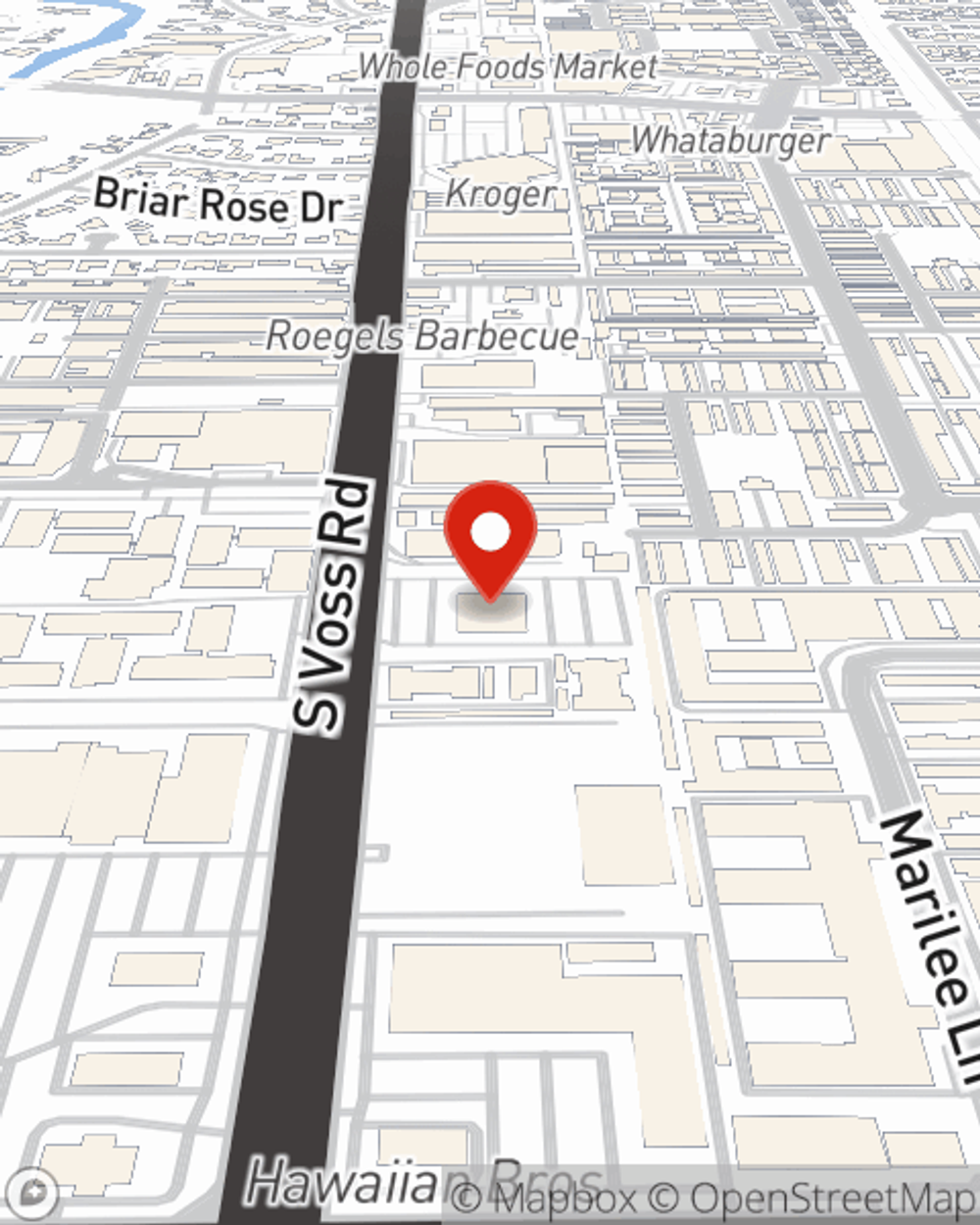

Houston condo owners, are you ready to discover what a State Farm policy can do for you? Reach out to State Farm Agent Jeff Thomas today.

Have More Questions About Condo Unitowners Insurance?

Call Jeff at (713) 780-4040 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Jeff Thomas

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.